Donald Trump’s political strategy may have a huge glitch: it could accelerate US debt to highest ever in history.

-

The Committee for a Responsible Federal Budget evaluated Trumps proposals and found that he would massively increase the deficit

-

The issue of US debt is a highly pressing issue, and will play a big role in the election

-

Trump tax cuts could add $9.25 trillion in debt over the next 10 years.

-

Hillary Clinton’s plan would add $1.4 trillion in debt

-

Neither candidate has put forward a formal plan to reduce national debt

It has been revealed in a startling report published by Committee for a Responsible Federal Budget, that with Trump’s proposals, the deficit would rise, not fall, as he has promised many times.

It was quite a challenge for the experts creating this report, as Republican Trump is mostly elusive about policy. He hardly mentions his stand on policy, and when he does it is not clear-cut and is inconsistent. However, this report takes into account the few public mentions he has made about policy and has created an estimate analysis with it. In comparison, Democrat Hillary Clinton is much more pronounced about her approach to policy, and provided much more concrete information for the researcher to work with.

What it crucially reveals is this:

Besides Donald Trump’s strongly expressed views against certain ethnic and religious minorities, he could also create vast deficits by introducing some highly questionable tax cuts.

This analysis conducted meticulously by the above mentioned committee, has combed together all aspects of Trump’s political agenda, and has taken into account what the policies of Presidential candidates will mean for the overall federal budget, which would eventually decide the total amount of debt held by the public. While some may protest the report’s claim by saying that Trump has promised to abolish estate tax, this report looks at the candidate’s overall political proposals till date, rather than individual policies.

The issue of US debt is highly pressing

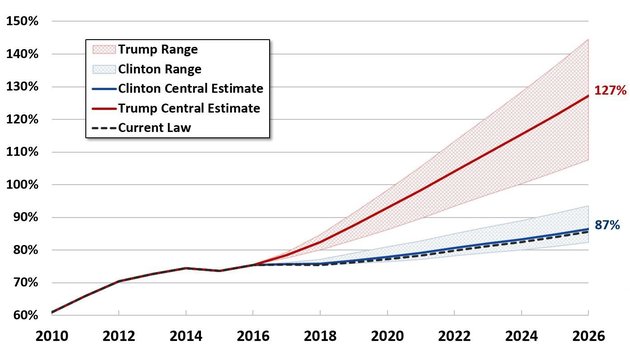

This is a stark graph of how US debt would possibly be affected with the two major presidential candidates:

The reasons why Trump could astoundingly increase US debt include:

- Trump promises various tax cuts, including new breaks for businesses which studies claim would unfairly benefit wealthy Americans

- Research by Tax Policy Center claims that this could end up adding $9.25 trillion in new debt over the next 10 years

- Trump also claims he will repeal the Affordable Care Act and reform veteran services

- This would further add few hundred billion dollars to debt

- Trump’s agenda could push the ratio of federal debt to GDP from its current level of 75% to a shocking 127%

In comparison, the previous US debt peak was at 110% during the 1940s, but this could be explained by the costs of borrowing due to fighting a world war.

On the other hand, Democrat Hillary Clinton’s agenda could cause debt of $1.4 trillion. However, her promise of focusing programs on early childhood and youth education, offer the hope of great economic benefit for the future. Additionally, Clinton wants to raise taxes for wealthy Americans among other strategies – which could bring in an impressive $1.25 trillion in revenue. Therefore, Clinton’s political agenda seems to have a better impact on the federal budget than Trump’s strategy.

Is Trump or Clinton better for the US federal budget?

The analytical report makes an important statement. It says, “To date, neither former Secretary of State Hillary Clinton nor businessman Donald Trump has put forward a plan to address the national debt.”

However, it also states, “Mr. Trump’s proposals would massively increase the debt.”

The answer is clear – while the US national debt is an issue that should be urgently addressed in political campaigning, Donald Trump’s agenda is likely to severely escalate American debt.